In this – the 11th Episode of The QuotersCast – Renee (your host and licensed agent) talks to Bryan Kuderna, who is a 15 year financial professional, author and Ironman athlete.

(VIDEO AND PODCAST BELOW…)

Hear what Bryan has to say about our connection to China and how this instructs his dealings with clients. Bryan is big on examining the Macro world to discover and consider more about our Micro world.

I found Bryan’s viewpoint to be insightful and valuable. I suspect you will too.

Find Bryan at the internet spaces below….

Bryan Kuderna’s business site: https://kudernafinancial.com

Bryan’s personal site: https://bryankuderna.com

Bryan’s book “What Do I Do With My Money?” on Amazon: https://www.amazon.com/What-Should-Do-My-Money/dp/1264857934

Watch Our Interview…

Listen To Our Interview on Podbean…

TRANSCRIPT Of My INTERVIEW with 15 Year Financial Professional, Author & Ironman Athlete – Bryan Kuderna

Renee Host of The QuotersCast: My guest today is a nationally recognized certified financial planner with a Masters in Science in financial services from the American College in 2021. He was named one of New Jersey’s top 10 financial professionals by NJ bins.

He’s the host of his own popular business and finance podcast, and he regularly contributes to mainstream platform such as CNBC, NewsMax, and AARP, with his first book published in 2016 entitled millennial millionaire. He became a nationally sought after speaker, and he’s here today with his second book entitled, What Should I Do With My Money? Economic Insights To Build Wealth, Amid Chaos.

He’s a husband and father of three, and he’s also a top level athlete who practices Brazilian Jujitsu, and he’s participated in an iron man and a marathon. So please help me welcome. Brian Kuderna, thank you. for being here.

Bryan Kuderna of KudernaFinancial.com: Yeah, thank you so much for having me. I’m happy to be here.

Renee of The QuotersCast: Sure, so let’s jump in with your second book, ’cause I think you’ve got a really interesting concept, you seem to stress that it’s the overall group concept, how people live, how they work, how they play, that determines corporations and nations and how they make money and how they lose money, and so kind of like the macro world connects to the micro world, so… Can you explain that? Constantly, I think that’s excellent. Yeah, I’d love to hear what you… How do you connect that?

Bryan Kuderna of KudernaFinancial.com: Yeah, so a couple of things. The way that I view wealth, and I define it in the book, which really kicks off the entire conversation is less from just a standpoint of pure money and the monetary decisions and consequences, and from this holistic approach of well-being. And so that’s where I look at wealth.

If you look at the etymology of the word, comes the word wheel, well, which actually means well-being, and so that’s where we get a lot of this holistic approach to making decisions that are not just purely mathematical, and then when you look at the micro-macro economies so many people feel like they’re just… They’re stuck in this gigantic system that they don’t know how we got here, and that it’s like, where does their decision, their investment, not at all to it all, but really billion people here, we all feed up to what make up these eco and micro economies become macro economies.

So that’s where I really connect those dots throughout the book, so that people really understand what their decision-making does for them.

Renee of the QuotersCast: Okay, alright, so on that point, I wanna put you as saying you must understand that money, your money rests at the heart of every major issue in the world, so we’ve seen exterior changes in the last two, three years, so I’d love to hear what you say about what’s been happening all around the world and how that affects us as individuals…

Bryan Kuderna of KudernaFinancial.com: Sure, and there’s so many examples that I could just pull from the right here and now, where you talk about here in the States, we’re dealing with hating our debt ceiling, and I saw a lot of people… Some people are freaking out about that. Others are like, Oh, we’ve done this plenty of times, it’s nothing new, and kind of the truth Canales somewhere in between there, but you know why are we hitting our death dealing…

Well, it’s all these different entitlements that we’re trying to keep solving, it’s your social security payment that you are gonna retire with, it’s your Medicaid that you’re depending on, can you pay your doctor bills with…

It’s the defense that we’re trying to keep up with China and protect our country, so there’s all these things that are unique to us as individuals that we want to have these different safety nets or these different protections, macro economy…

Even if you just look at recent banking turmoil over the past couple of months, again, It’s individual’s decisions of, We’re digesting some data, where… Creating an interpretation of that data. Is the bank gonna stay solvent, we’re spreading this kind of minor rumor that can grow into something much more, and then one of us is acting on that saying.

Okay, with the click of a button, I’m going to withdraw my account, and then that one becomes many and then all of a sudden, we have an evolution of what’s going on to our bank system, so there’s just so many of these little whispers that they start out at that create the regulation and the systems that we live within, and then that ultimately dictates the kind of breadth of our economy.

Bryan Kuderna of KudernaFinancial.com: So I think that’s where we can start small and kind find our way all the way up to the top of the mountain, or we can start at the top of the mountain and work away all the back like that with whatever I’m investing in. Whatever I’m voting for and the like, and that’s where I think it’s really cool to see how all these little micro-economies fit together.

Renee of The QuotersCast: Okay, so now you have… You created Kuderna Financial, and so when people come to your company, how do you sort of integrate them, number one, how do they find you? And number two was sort of the intake process based on that philosophy… Yep.

Bryan Kuderna of KudernaFinancial.com: Yes. Firm is financial team. I’ve been a practicing advisor since 2008, so people can go right to Adana financial dot com, find out my more day-to-day job.

Where do they come from?

A lot of my clients at this stage come from word of mouth, where I initially generated all of my business was three doing seminar marketing, so that was a lot of going out to hospital located in Antlers, workshops. Insurance planning, retirement planning, etcetera.

And then where the book has just created a lot of buds from a PR standpoint, but it’s also practical in the sense that clients can read that and figure out from an economic standpoint how things work, like, Why do we even have these products? And how did they get to be that way?

So that when we prescribe a financial plan and they ask them, it’s the right move, should I do X, Y and Z, now they can understand the rationale behind Tate macro standpoint, and then funnel it down to their own init of that what we want is getting the conviction to say, Okay, now I get it, now I get one, and I’m gonna stick to the plan.

Just like I would… My workout regimen, or my diet, and then I can benefit from the results.

Renee Host of The QuotersCast: Alright, so I wanna see what that looks like because there’s a lot of financial planners who cannot do that or they don’t do that very well, and it sounds to me like, Yeah, you’ve got this un-locked down, so really take us through if somebody… If I was coming to you right now, how would you start… What are the questions you would ask? And what’s your goal in your end to help me. Sure.

Bryan Kuderna of KudernaFinancial.com: Yeah, so in short… And I do have a process to that, and I say You gotta have a process, that’s what one guess work out. Number one, can come to me with our 22 years old and starting their career, where it’s a 70-year-year-old couple, Ultron neurology plan. The first thing I’m asking them is, How can I help you? If we work together over the next five, 10, 15 years, what do you want to accomplish? Alright, so that’s where we start with, tell me about you, tell me about what you wanna get out of this.

And then on the flip side… And ask him now, does anything keep you up at night? Do you guys have a worry that when the day is over, are you and your partner gonna fix this. This is bothering us, whether that be a debt, helping a kid with college, figuring out their state plan, where they’re gonna retire to…

Whatever it is, I wanna have those kind of open-ended dialogues, get to just know each other as people, that’s that one into the actual financial…

In going over all the gaps, the exposures, the insurance is and the like, then it’s focusing on liquidity, then step three is managing any deaths, particularly some of the toxic or the high interstates, and then the fourth one, once we have, again, protection, our debt in good order.

Then we get into the growth component, which is much more of the investment portfolio management.

Renee of the QuotersCast: Now you must be nice from insurance to being a registered graph in your series 6 and 7, all that, so you can encompass all of it, so from growth to protection, can we drill down a little bit more on the actual products that you offer, what are some of your favorites that you often suggest for people…

Bryan Kuderna of KudernaFinancial.com: Sure, yep. So when I started out of college at… The first thing I did, I got life and health insurance licensed. Alright, so I think that’s a good starting point for a lot of folks. Specialist mantra that I believe.

And then I believe it was in 2009, I got my Series 6, and then shortly there after the 63, 65 and then the 70.

So I got all those securities licenses, I got my insurance licenses… Not too long after that, I got my CFP to be a certified financial planner. That did two things that added obviously a lot to my knowledge, but I think it also gave me a lot of credibility, especially being so young at the time, 24, 25, trying to advise retirees on their life’s work, so that was kind of my credentialing as I was getting my training wheels taken off, if you will, and so within that vein, if we just look at my business right now, if this helps give context.

I would say it’s probably maybe 40% disability insurance. I have a niche that I work on with physicians around the country, very important to protect their skill set.

So, I do a lot of disability, maybe about 25% or so life insurance, and then the remaining 30% to 40% any given year, wealth management practice.

Which is a combination of everything. Money under management, passively managed mutual fund accounts and that of course, annuities, and so that’s kind of my product mix, if that helps.

Renee of The QuotersCast: Right. Yes, it does. So did you work at some large corporations first to get experience before you opened your own company?

Bryan Kuderna of KudernaFinancial.com: Yeah, it’s a great question. So I began my career with an internship, the firm was called International planning alliance, and so they were a non-captive agency that could offer insurance products and such, but then also aligned with a broker DR and then…

So I still related with that parent company of sorts, with that umbrella agency, and that it was, I wanna say in 2033, buyer doing business as a…

They’re in a financial team, so from the get-go, I was making my own book of business, my own practice, starting right out of college, and then from a branding standpoint, wanting to have some more own… That’s when I created my team.

Renee of The QuotersCast: Alright, that’s great. So have you had an opportunity to travel a lot and actually see other economies and societies and how money is circulating in other countries?

Bryan Kuderna of KudernaFinancial.com: Yes, and that’s a great question, ’cause I think for a lot of folks, the majority of people out there, it’s kind of… We’re just seeing what we see on the news and we’re trying to read the best journals we can and kind of think this on from a kind of like most arms like the way… And then make decisions based on that, which is fine.

That’s the way it is for most people. One advantage I had, and I did carry this with me throughout my career in my life, was when I was a senior at the College of New Jersey, I had the chance to study abroad at The University of economics in Prague.

So not only did I learn a lot there at the coolmore importantly, I was at a school with students from all over the globe, all the countries in Europe, from America, all these different states in America, from Asia and here with all these kids, 21, 22 years old, and you’re doing the same things, you have the same wishes, the same dreams, and you’re just living a world away.

So, it’s just such a great opportunity and you see kind of what makes it tick… At the end of the day, we’re all the same, but we’re all a little bit different too.

And so it’s just really such a rewarding experience to then I take with me throughout life.

Renee of The QuotersCast: Yeah, that’s great, I love that. You also mentioned how does the acronym mice, which means meetings, incentive, conferences and exhibitions, can you explain that and sort of incorporate that into your… Your philosophy. How does that work?

Bryan Kuderna of KudernaFinancial.com: I’m laughing because you read, I guess as an acronym, I’ve never heard, ’cause if we’re a reference and that was really good, that it’s probably very applicable to what I do.

So the mice that I use as kind of like a frame of reference for my entire book, when I was in college, I wasn’t really sure what I wanted to do yet, I read a book on the CIA, the Central Italian, it was a really cool book.

I’m drawing a blank on the name, but what they did is they talked about how they train their spies, so that when they’re moles, when they’re behind enemy lines, how do they embed themselves with the enemy and get those deepest, darkest secrets out of them.

And one of the things that they were taught was to use mice, and what that meant was money, ideology compromised an ego, so a little bit of a different definition, but what that has…

That guides their decision making. And so now here I am writing this book on all the different domains of evacuate, how people from mom and dad at the kitchen table, up to leaders of nations negotiating. What are their motives? And how do they make decisions?

And you think of it, the mice, the money, the ideology, compromising the… Play into all of that.

And so that’s where with each of these kind of massive issues, iron title, and you stuck taking into context, mice.

Renee of The QuotersCast: Okay, so that sounds like that’s your personal acronym and that you took from that book, but… How do I put this? It’s interesting that you built that from a book on this CIA, because I do think that it’s…

The CIA is part of the dark under belly that kind of stir things up in the society… I don’t wanna go down the rabbit hole too much, but certainly this talk about the Deep State, they have to have an influence, they just have to in our economy and elsewhere, so I just think it’s interesting that you merge into… And so what do you think of that?

Bryan Kuderna of KudernaFinancial.com: Yeah, yeah. And there wasn’t any direct correlation, it was just something I remember way back when when I read that, that it stuck with me is like you always wonder how do the best of the best of this…

That are Trump people’s heads. What’s the tool? What’s the mechanism they’re using? AlsoWhat’s the psychology there?

And so that just simple acronym mice always stuck with me, and so then as I started to write this book and I was doing all of this research of why things are the way that they are, why do we…

You certainly negotiate with certain countries, why do we come up with certain tax law, why investments do better than was remembered, those motives, they’re just inherent to humanity, and so again, not a direct correlation, but that became kind of a part of my thought process, and it just became very apparent in my research, and so that…

I wouldn’t say that the CIA… You really had anything to do with the book. It was just an acronym that happened to be there that then influenced some of my outlook.

Renee of The QuotersCast: Okay, so do you think the CIA has anything to do with manipulating the economy in any way, shape or form.

Bryan Kuderna of KudernaFinancial.com: They do to my book, but if we just take a step book and can say that’s just one weapon of sorts that our country has at its disposal, to gather data on the international community to gather intelligence and then make that couple for things which can be economic or otherwise, the tremendous effect.

That’s one of the messages I try and preach in my book, is that whether we like it or not, or whether we recognize it or not, economics finds its way into everything, so every decision that we make, usually it has an economic impetus.

Do we wanna spend more or less money for dinner tonight, and then there’s an economic consequence, so even if we didn’t think about that, if it was just an emotional.

I want X, Y or Z, that comes at a cost, whether it be financially or otherwise, because we gave up our time or our toil, to get that.

And that’s where we talk a lot about lost opportunity costs, an economic term that every time we decide to buy something or to do something else, not only did that cost what the sticker price was, but also there was the cost of where else that money could have gone… And so that just is like a whole another wormhole of decision-making, but that’s economics.

Renee of the QuotersCast: So how does economics play into your passion for exercise and running marathons and doing the Iron Man, how did that influence your career now? Yeah.

Bryan Kuderna of KudernaFinancial.com: Yeah, so from like I’m a surface value and economic connection that would be done… Again, there kind of is.

So if we think about it, we have the passion for exercise, that’s just kind of my outlet to try and stay healthy and to be able to compete and to have a scratch that itch that’s always been there from playing sports.

And then I think as I do that, that just makes my mindset a little bit clear when I go into a business, whether it’s how I’m working with folks at the office, or what my mood is as I’m meeting with clients and everything.

So I think everybody wants to be healthy and wealthy. It’s a common saying. And another one, we spend our life time chasing wealth at the expense of health, and then we could spend those later or years now trying to chase health that’s costing all of our… Well, more… Try and have both.

Let’s have our cake and eat it too. And a lot of people can do that, just going out for a walk or after the meeting, doing some push-ups or going to the gym, for me, I’ve always needed kind of a routine.

I’ve been very goal-oriented, and I think that’s where having the marathon they are having the iron in there, having those marquee events just push me all the water, and it’s a very similar outlook to what I take with my business, that I have goals and I wanna accomplish…

I have a book that I wanna write by X date, and it’s really no different than the track I try and take to physical fitness and sports.

Renee of the QuotersCast: Okay, excellent, so what country worries you the most in terms of being able to sort of upset the American economy or any outside force? What do you see as the biggest threat?

Bryan Kuderna of KudernaFinancial.com: Sure, yeah, I think… And we talk a lot about that in the book too. There is a chapter on war, which has been here since the beginning of mankind, but it’s certainly evolved and there’s economic warfare, and there’s traditional warfare, which…

Do we get into both which country it’s… Of course, it’s China without question.

If you look at right now, on the macro economy, global economy, there’s two super powers, it’s the ASIN China, two biggest economies in the world, where we’re extremely interconnected, and I think that that actually is the silver lining in that we never wanna decouple our economies or it would be devastating to both of us outside of America…

Our biggest customer is China, outside of China. Their biggest customer is the US, so it behooves us.

Even if we disagree on a lot of things, we have different outlooks, it’s a… People essentially keep us tied together to an extent, so I think that that’s kind of the silver lining there, however, their economy is growing or has been growing over the past 40 years, very rapidly. They were not a super power that long ago, whereas we were…

So one could say where we’re slowing down and they’re picking up speed, and there’s a whole lot we can get into with that, but I think from a national standpoint, China, they’re elephant room, and there’s a whole another kind of threat out there that is not just nation to nation.

It can be the more of these loan Wolf, the hack or the crazy guy that maybe just has some knowledge or have some influence, and because of technology nowadays can find their way in and re-havoc from almost like a terroristic stand point where they can create terror on a micro economy, which can again, much into per economy.

And I think that’s where… What all voices come. Loud voices.

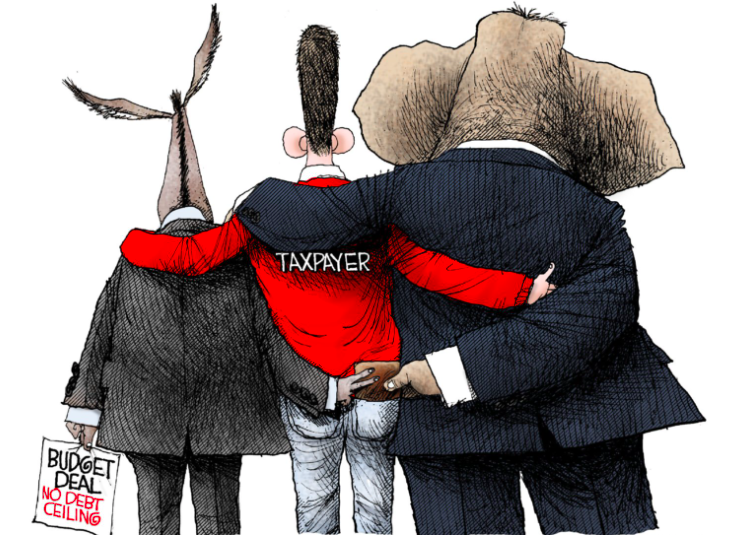

Renee of The QuotersCast: Yeah, you make an excellent point. And so to that point, you say that we are interconnected with China as we are with all many things and many people, it seems like our politicians though seem to be about division and destruction, so how do you…

You’ve got 15 years in studying this and helping people deal with their money, and so I can see that would be things to consider, the macro and the micro world, and so leaders…

When our leaders have different views than say we do, because individuals are incentivized to have harmony, how do you balance that in your work?

Bryan Kuderna of KudernaFinancial.com: It’s a great question. So I would say that there’s kind of a two-part answer there, number one, vote and study before you vote. I think that’s kind of the first thing, again, that’s something that people died for that right to be a tens of people around the globe that wish or say an Wein, a democracy.

So I think that’s something that we need to treasure and we need to recognize the importance of that. That would be number one.

Number two, going back to the here and now, me and my family, my financial plan, and I turned on the night we need and I just see the Left and the Right screaming and yelling at each other like children…

And it’s driving us nuts.

I think you just can’t get too wrapped up in it, you need to say, Okay, I’ll pay attention to what’s going on, what the dialogue is, I’m going to based on my knowledge, make my assessment, and then I’m gonna go with my life.

Alright, and do so just as I would otherwise. And I think that’s the best course of attack, I think a lot of people get drawn in because the media now has such strong biases as well, they’re showing you probably the worst of the worst, and they’re showing it from their vantage point ’cause they want you to think a certain way, or they already have a prescribed audience that they need to satisfy.

So it’s like we’re not watching the news, it’s almost like we’re turning on a day show and we’re just watching that show because it’s entertaining us or it’s kind of firing us us up because we wanna get fired up and those things, there’s just no win in that, so I have her to turn it off and do something more productive.

Renee of the QuotersCast: Good idea. So one last question, Ryan, there was… Yeah, you had sent me a few list of questions, and I really appreciate that there was one on there that you said, maybe I should ask you about what your Rock Bottom lands… People like hearing about that. When I do a lot of these speaking gigs, everybody think there’s relatable.

Bryan Kuderna of KudernaFinancial.com: And I would say from a professional standpoint, it was really those early years of my career trying to build my own wealth management practice, my own insurance practice, where being independent, you’re essentially commission-based, it’s what you kill.

I wasn’t tied in with a bank or with a wire house that said, Hey, here’s your 50000 salary, and then is on the way commissions and things, if I didn’t generate new business…

If I didn’t go out and get a client, there was no production, there was lose your office and go home without a paycheck.

So I think in those early years of Is that tug of war of like, You know what, I am, who I am, and I wanna be really good at what I believe in. From a financial planning standpoint, now I need to help other people see it and help develop some confidence in me to be able to work together, so… Those are our years.

There were times, I think it was a second year in the business, so mind you, I’m only 23 years old at this point, but just my productivity put me in such a way that I wasn’t even able to collect the Draw for my contract, and so I was gonna go on suspension,.

Which meant that literally, I was going into the office, I was working cold calling, pound the pavement, going to networking events and not being paid.

I was literally working to try and develop a practice, but on the hopes that someday I would repay me and so I think that was kind of a point.

Bryan Kuderna of KudernaFinancial.com: Being in a family that was all just normal salaried government employees, things like that, that when it came to coming home at night and saying, how did you do today? Or you make a money, and they just couldn’t…

My parents or my brother couldn’t wrap their head around, you’re working your tail off, you’re putting in these long hours, you’re paying to study and to get these licenses, and then you’re not making any money. Like, what are you doing?

But that’s the life of the entrepreneur in… I was able to stick with that vision.

So I think that was kind of the rock bottom where one, I knew it was tough and to the people around me were telling me, it’s tough. And you’re crazy. That you start to question like, Is this for me?

And that’s why I think you really gotta go back to that vision, which I did, and it gets you through that time, and now here you are, thankfully, knock on wood, a decade later, and business is thriving, I’ve got the book, The podcast, all this exciting stuff.

But people are very quick to forget how that was at the beginning, and so I think that that’s maybe a little rock bottom story.

Renee of The QuotersCast: Well, good for you, good for fighting through that because I’m fairly new with this too, and it seems like that’s actually pretty common, and I didn’t know what I was getting into, but the cold calling, all though, everything you said is just absolutely accurate. And I’m starting a lot later than you did, and just one last question, ’cause we are running out of time, but what would you say…

I guess it’s kind of two-fold, ’cause you hire people into your agency and also if you could offer something to the listeners on how they can get through that initial stage and what you do for your employees when they come on to help them get through that stage up.

Bryan Kuderna of KudernaFinancial.com: Yeah, so I think what I try and tell a lot of folks that are starting it out in the career is that numbers matter…

So I think that’s where a lot of times when people get recruited into anything, whether it’s any position out there, the person that’s recruiting is selling them on the nice position, this nice career, this nice agency or office and welcome the board, things are gonna be great.

And then this wake-up call is like, Oh my gosh, I got out and no one’s sending it to me, so I am a bit of a realist in that point, but then I will know, I look at the light at the end of the tunnel, and then have faith that if you follow this process, that it’s all going to be okay, and then even if it’s not, it’s still gonna be okay, because then you figure out what you’re supposed to be doing.

So when I started in the career, I remember I heard from a gentleman said, You wanna scale seven points, you got 15 calls, a point for taking on a new client, and then a point for having a meeting with a perspective client, so I could control that.

I could noise control how big of an insurance policy I sold or how big of a retirement plan I took over, but I could control getting to those seven points every day, and if I had a few meetings, alright, well, I need four points left, so that might be 60 phone calls, which back then 15 years ago, that’s really what we were doing.

So I think going back to just control on what you can control, knowing it’s gonna be tough, but embracing that and keep that vision on where you wanna be in 10 years, and if it’s worth it to you, then get after it, if… At some point, you find out it’s not, or you’re just not enjoying the journey, but do something else.

Renee of Th QuotersCast: Well, that’s excellent advice. Thank you very much, Brian, I appreciate you being here. I encourage everyone to look for out for your book, what should I do with my money? And visit your website or a financial dot-com. Where else would you like to send people?

Bryan Kuderna of KudernaFinancial.com: Yep, yeah. So yeah, they can get, what should I do with my money? Anywhere books are sold. It’s available paperback, Kindle, and audiobook as well. And then you mentioned my business website, I also have a personal website, just Brian Kadena dot com, that’s Bryan with a y. They can go there, they can read my blog, I get find out about my pod mound-ings and things that I’m passionate about.

Renee of The QuotersCast: Alright, well, thank you very much and I wish you continued success Brian.

Bryan Kuderna of KudernaFinancial.com: Yeah, my pleasure, thank you for having me.

Renee: I loved it. Thank you.

Bryan: Awesome, take care.

Renee: You too.

——————————————————————-